Smart credit

If handled wisely, credit is a tool you can use to reach your goals. Good credit can offer convenience, some consumer protections, and the ability to purchase a home or car. Credit can, however, be expensive and many consumers struggle with excessive debt because of credit mismanagement.

Why is good credit important?

Your credit will be checked when you apply for a credit card or borrow any type of loan. It may also be checked when you apply for insurance, rent an apartment, or sign up for utilities. Some employers may also review your credit report, especially if you will be responsible for funds or assets.

-

- Everything You Need to Know About Credit (article)

- What is Credit and Why Do I need it? (video)

- The Effects of Bad Credit (video)

Credit scores and credit reports

A credit report is a detailed record of your credit history. Your credit report is maintained by credit reporting agencies or credit bureaus, such as TransUnion, Experian and Equifax. Lenders and creditors can use your credit report to determine your risk as a borrower. You are entitled to one free credit report every 12 months at annualcreditreport.com. You will only get the report free at this site, but you can obtain your FICO credit score for a small fee.

A credit score is a number that represents your creditworthiness and is based on your past and current credit files sourced from credit bureaus. The range of credit scores for the FICO scoring method is from 300 to 850. The higher the score, the better your credit. High credit scores can help you qualify for loans at lower interest rate charges. For the best rates, your credit scores should be 720 or above.

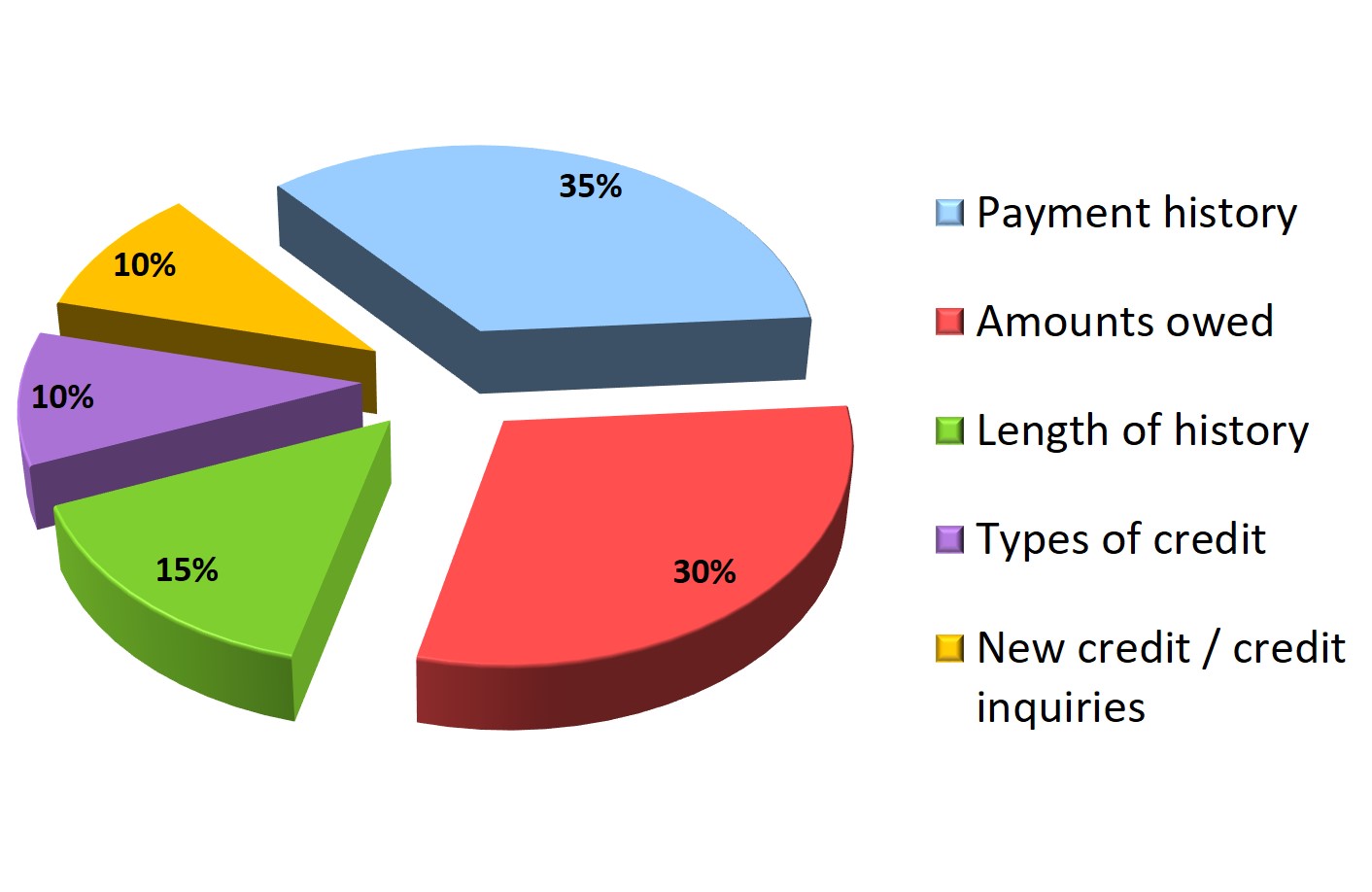

According to myFICO.com your credit score is based on the following:

- 35% is based on your payment history and whether you pay on time.

- 30% is based on the amount you owe compared to the credit you have available.

- 15% is made up of the length of your credit history, with longer relationships with creditors viewed favorably.

- 10% rates how often you shop for credit and open new accounts.

- 10% is based on the kinds of credit you have, with a mix of cards and loans preferred.

Establishing credit

If you understand how to manage credit wisely, then there are a few simple ways to begin to establish credit:

- Student loans are on your credit report so proper repayment is important.

- Learn more about the ins and outs of how credit works at iGrad-WSU.

- Talk to your bank or credit union about a credit card. Some websites offer credit card comparison tools.

- Your bank may suggest a secured credit card with a bank account to back it up.

- Other types of loans such as auto loans may be an option.

By establishing a form of credit, and managing it wisely, you can begin to show lenders you are responsible and trustworthy with credit.

Improving your credit

Start by identifying key areas on your credit report that need attention. Make sure your credit report contains accurate information. Report incorrect information immediately. By clearing up incorrect information, you may find your credit score will improve. Other tips include:

- Pay your bills ON TIME!

- STOP using your credit card and accruing more debt. Pay off your credit card every month and do not carry any balances.

- Use credit sparingly - try to stay under 30% of your credit limit.

- Limit yourself to just a few major credit cards.

- Do not close long-standing credit accounts. A longer credit history will help improve your credit score, especially if you maintain these accounts in good standing.

- Do not open accounts that will only be open for a short period.

Stop unsolicited credit offers

Visit the FTC website to learn more about prescreening and how to stop unsolicited credit card offers. This website also gives information about the National Do Not Call Registry, which reduces telemarketing calls.

Identity theft

Security breaches can be scary. Some companies are more successful in implementing security, but with data flowing between servers all over the world, any online information is at risk. If you are reading this article, you probably have a digital footprint of some kind and will want to protect yourself with good online security practices. The Federal Trade Commission offers information about how to protect your identity and what to do if it is stolen.

-

-

- ID Theft Risk (tool)

- Protecting Your Identify (video)

- Consumer Protection Against Fraud and Identity Theft (video)

-